Is Your House An Investment Or A Home?

Embarking on the great adventure of real estate is exciting and full of possibilities, but the road you travel depends greatly on one main question. Is your house an investment or a home? At first, you may see little need to distinguish between the two, but your answer shapes every decision you make when it comes to your house.

Always thinking about how much your house is worth, appealing to more buyers, and protecting your asset indicates you see your house as an investment. Concentrating on comfort, personal style, and how your house reflects your personality shows that you see it as a home. Finding a balance between the two can help you achieve the best of both worlds.

How you take care of your home, from decorating to maintenance to renovations, depends on why you’re doing it. Is it because you plan to live in it for years to come, or is it because you plan to list it in a few years for a quick ROI?

Furthermore, even if you plan to stay in your house for many years, do you still see it as more of a path to wealth than a home? Discovering where your preferences lie is important as you begin to navigate the decisions surrounding your largest asset.

Thinking About Your Home As An Investment

Seeing your home as an investment means you view it primarily through a financial lens. You think about things like resale value, how the neighborhood is growing, and what buyers want.

There’s nothing wrong with thinking this way. It simply means that you’ll make most decisions about your home based on what type of financial payoff they bring.

How Viewing Your Home As An Investment Affects Your Decisions

You tend to prioritize renovations and upgrades based on how much they’ll boost the overall value of your home. It’s all about the return on investment (ROI). Therefore, if something isn’t worth it financially, you might skip it, no matter how much you want it.

When it comes to home maintenance, you’re likely hyper-focused and particular. You stay on top of routine repairs like HVAC service, and you address issues quickly.

A leaky roof isn’t just an annoyance. It has the potential to become a bigger problem that ends up dragging down your home’s value. You don’t just see repairs and maintenance as tasks to check off a list. They’re asset protection.

Viewing your home as an investment also affects how you plan renovations and make design choices. You always think about mass appeal to attract a broader buyer pool, so you play it safe. Timeless styles, neutral palettes, and more mainstream finishes are your go-to choices. You also pay close attention to what upgrades other homes in your neighborhood are making. The goal is to keep pace without over-improving your property.

Your House Is A Home, And It Reflects Who You Are

On the opposite side of the fence from seeing your house as an investment, is seeing it as home. Everything you do in your house is a reflection of your style, preferences, lifestyle, and loves.

When you decide to do something in your house, your first thought is how it will add value to your life than than to your bottom line. You put more emphasis on making your home comfortable and inviting.

How Seeing Your House As A Home Affects Your Decisions

You focus more on livability, comfort, and enjoyment. Who cares if a deep-soaking tub may not be the first choice for bringing a high ROI? You know you’ll use it all the time and enjoy it immensely, so you splurge.

You also care about maintenance because you want your home to be nice. However, you’re not fixing it because Zillow tells you to. It’s about making your house the best it can be for you, and because you take pride in it, not because you want to make it perfect for buyers.

One of the biggest differences between considering your house as an investment or a home, is in the design. When you see your house as more of your own place, you’re going to make style choices based on what you love.

Mass appeal and mainstream style aren’t the driving forces for your renovations. Instead, it’s all about curating a look that is uniquely and unarguably you.

The Best Of Both Worlds? Bringing Your Head And Heart Together

If you’re like most homeowners, you fall somewhere in between these two extremes, which is a wise approach. You consider your home an asset, but also understand that you need to make it something that reflects who you are.

The main challenge is to decide whether your head or heart should take control of certain decisions. Here are a few tips to help you know which is the best route to achieve personal and financial satisfaction.

1. Divide Decisions

Not everything you do with your house has to be black or white. Some things will require more financial consideration, while others will merit more sentimentality.

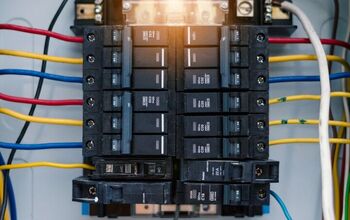

For example, anything that directly affects your home’s value or structural integrity falls into the financial category (like a bad roof or faulty wiring). However, creating a cozy reading nook or switching to a funky, vintage light fixture is more emotional, and that’s perfect.

Some decisions will be more about how your home functions for you. For example, you need built-in storage in the garage or want a smart thermostat. Learn to categorize your decisions so you don’t feel a need to look at everything through the same lens.

2. Consider How Long You Plan To Live In Your House

How long you plan to stay in your home drastically affects how you do things. If you plan to sell in less than five years, it makes more sense to prioritize things that boost your resale value.

On the flip side, if you know you’ll be in this home for over ten years, lean more toward what you love. This is especially the case if you’re in your forever home.

3. Distinguish Between Maintenance And Upgrades

Whether you think your house is an investment or a home, maintenance is non-negotiable. Failing to make repairs doesn’t just decrease resale value; it also hinders your comfort and quality of life.

However, upgrades are another story. Be honest and clear about the projects you plan for your home.

Don’t jeopardize your finances on a costly renovation because you think it’s protecting your investment. Replacing a leaky roof is necessary, but upgrading to a five-burner stove and gourmet kitchen isn’t.

If you identify upgrades that add resale value and better your life, that’s the sweet spot. Consider changes that make you happier, add convenience to your day, and improve your well-being. If the benefits you get make the change worth it, then go for it.

Define Your Home’s Role Before You Make Big Decisions

Overall, how you view your home is up to you, and there really isn’t any right or wrong answer. However, you do need to decide what your house’s primary role is in your life, so that your decisions make sense for your big picture.

Whether your main focus is on finances or function, comfort or commodities, it will influence the choices you make. In some cases, you may start out viewing your home as an investment, and over time, start to see it as more of a home.

For many homeowners, their homes fall somewhere in between the two extremes. And the same can be true for you. Your home can be a financial asset as well as a comfortable retreat.

The biggest takeaway is to make sure you’re intentional with all of your decisions, whether they’re guided by finance, function, or form. At the end of the day, investment or a home, what’s most important is the life you live inside and beyond your four walls.

Related Guides:

- Budget-Friendly Ways To Give Your Home More Curb Appeal

- How To Evaluate Homes For Sale: What To Look For Beyond Curb Appeal

- Budget-Friendly Home Upgrades That Look Expensive

Stacy Randall is a wife, mother, and freelance writer from NOLA that has always had a love for DIY projects, home organization, and making spaces beautiful. Together with her husband, she has been spending the last several years lovingly renovating her grandparent's former home, making it their own and learning a lot about life along the way.

More by Stacy Randall