Did You Buy Too Much House? Seven Hidden Costs Of Extra Space

When you’re house hunting, it’s tempting to fall into the trap of thinking that bigger is better. You're dazzled by large, luxurious kitchens, flex spaces, and staggering square footage. But then you move in and realize that extra space might be more than you bargained for, in more ways than one.

A bigger house comes with hidden costs, some financial and some that affect your lifestyle. More square footage means a higher mortgage, costlier utility bills, increased maintenance, and even more stress. You also spend more time on cleaning, upkeep, and decorating. And there’s often an added weight of trying to keep up appearances when you have a larger home.

There’s nothing wrong with buying a big house. However, it’s important to understand the overall price of your extra square footage. Otherwise, you could quickly feel like you’re living to serve your home instead of the other way around.

Check out some of these common indicators that you may have bought too much house, and see which ones apply to you.

Seven Ways To Know You Bought Too Much House

1. You’re Blindsided By Bigger Bills

The most obvious cost of a bigger house is the increased expenses you’ll pay in terms of the mortgage. A larger house typically means it’s more expensive, which also means you’ll pay more for things like property taxes and homeowners' insurance.

Assessors typically determine property taxes based on a percentage of your home’s value. Likewise, homeowners' insurance usually scales with your property’s value and size, and the more space you need to protect, the higher the premiums.

Is it too much? If your property tax bill or insurance premiums are pushing your monthly payment over your comfort threshold, you may have bought too much house. Also, if your utility bills are so high that they’re throwing your budget out of alignment, this could be another negative sign.

2. You Feel Pressure To Fill All The Space

Do you feel like you’re walking through your home, wondering what to do with the extra space? There’s a spare room you’re not sure about. Should it be a guest room or a home office? Should you put some expensive gym equipment in there, even though your idea of a workout is carrying a load of laundry up the stairs?

Once you move into a larger home, you may feel pressured to fill the empty rooms and walls as soon as possible. All of this furniture, decor, and artwork adds up quickly. A new bedroom set could cost you anywhere from $1,500 to $3,000 or more, and don’t even start with the extra lighting fixtures, curtains, and rugs.

Is it too much? Are you finding it hard to decide what to do with certain rooms? Are you rushing to buy things simply to fill the space, getting things you won’t even use?

For example, you turn an empty bedroom into a media room, just because you saw the idea on Pinterest? (However, you always end up having movie nights in the living room.) Are you always worried that you need to uphold a certain image since you have a larger home?

3. The Maintenance Multiplies Faster Than You Can Handle

One of the downsides of a bigger home is how much time it takes to clean, repair, and maintain it. Of course, if you have the budget for it, you could hire professionals to handle things for you, like a cleaning service, landscapers, and repair specialists.

But if not, and you’re working with an average or modest budget, you likely plan to handle a lot of maintenance yourself. Saving money by cleaning your own home and tackling small repairs is great, but there’s still a time cost.

If you bought too much house, that cost can be extremely high and wear you down mentally, physically, and emotionally. And don’t forget about the outdoor spaces. A bigger yard often means more time spent on lawn care, gardening, and other exterior upkeep.

Also, when you have a larger house, repairs and home maintenance cost more financially. You’ll pay more to replace that larger roof, those extra windows, and even more doorknobs. (You’ll spend a lot more when you have 35 doors instead of 10.)

Is it too much? If you feel like you’re devoting more time to taking care of your home than enjoying it, it might be too much for you to handle. Also, consider if you go into panic mode when something starts to break, because it’s too expensive or a huge hassle.

4. You Get Way More Stuff Than You Need

The more room you have, the more likely you are to end up with a bunch of stuff you don’t really need. At first, it doesn’t seem like a big deal, because, after all, you have the space for it.

However, all of that inventory requires upkeep and care, not to mention you spent money on it, too. You also have the additional cost of storing it, whether it’s purchasing bins, a shed, or some other type of containment solution.

The psychological cost of clutter is also massive, leading to higher stress levels that make it much harder to relax. The more things you possess, the more difficult it becomes to find items, get things done, and clean.

Is it too much? If you’re buying duplicate items, wasting time trying to locate things, or feeling overwhelmed by your stuff, it’s too much. Does your larger house tempt you to acquire more things than you need?

It’s easier to grab things here and there when you feel like you have to fill the space. Do you find yourself making impulse purchases because you know you’ll have a place to stash the things you buy?

5. Your Home Lacks Energy Efficiency

Depending on your level of environmental consciousness, the impact on the planet may not be a concern for you. However, one thing that would surely make an impression is the cost of heating and cooling rooms that you barely use. Smart thermostats and zoning systems can help, but those also mean you’ll pay additional costs.

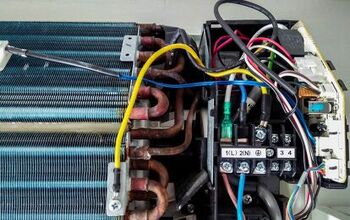

Extra square footage often leads to poorer energy efficiency, especially in older, large homes, which translates to higher utility bills. Plus, outdated windows, insulation, and HVAC systems can’t manage big spaces very well, requiring expensive updates, retrofitting, and replacements.

Is it too much? Do you struggle to heat and cool your home properly? Are your utility bills too high because you’re forced to heat and cool too many rooms?

Are the systems in your home breaking down or struggling because they can no longer keep up with the size of the house? You might start to notice you’re scheduling more frequent service calls or having to add extra steps to routine maintenance.

6. You Have To Change Your Lifestyle

Think about how much time you spend taking care of your house. Now, think about how the extra costs affect other areas of your life. For example, now that your utility bills are higher, do you eat out less?

Did you trade a larger home for a longer commute? Now, instead of enjoying time with your family at home, you’re spending an extra two hours a day in your car.

These things may not seem like big deals when you look at them individually. However, put them all together, or add them up over time, and they make a huge impact on your way of life.

Is it too much? Does your extra square footage keep you home more often now that you have less money to spend elsewhere? Are you noticing significant changes in your lifestyle after moving into a bigger house? For example, you don’t attend concerts as much, you don’t eat out, or maybe you stopped getting monthly mani-pedis.

7. You’re Struggling To Sell Your Home

What if you’re trying to sell your home? If you’re in a slow market, then it can be tricky to sell a larger house. It has a higher price tag, but savvy buyers also know that it’s going to come with more upkeep, maintenance, decorating, and other costs.

This isn’t to say you should never buy a large home because you may have difficulty with resale later. However, it is something to think about, especially if you don’t need a big house to begin with when you’re on the hunt.

Tweak Your Budget If You Bought Too Much House

Overall, the costs of buying too much house are financial and emotional. If you’re still not sure, use this quick checklist to determine if you may have bitten off more than you can chew when you bought your home.

- Your monthly housing expenses (mortgage, property taxes, insurance, and maintenance) exceed 30% of your gross income.

- There are rooms in your home that you rarely or never use.

- You put off repairs or important updates because you can’t afford them.

- You’re struggling to make payments and feeling a lot of pressure after paying your bills each month.

- You feel like you spend more time maintaining your home than enjoying it.

If several of these points ring true, you might have more home than you really need. At the very least, you likely bought a bigger house than you can afford.

What Can You Do About It?

Before you start searching for real estate agents and putting a For Sale sign in the yard, try these tips to improve your home situation.

- Downsize your space within your home. Close off unused rooms and research ways to adjust your heating and cooling zones.

- Turn extra space into income. Rent out a room, basement, or garage storage.

- Simplify your stuff. Declutter your home, and sell unused furniture and home goods.

- Tweak your budget. Meet with a financial professional to see if refinancing is wise. Go over your budget with a fine-toothed comb to see where you can save money. Shop around for cheaper insurance, and consider getting a home-energy audit to try and lower utility costs.

Did You Buy Too Much House?

Buying a home is a major milestone, but that doesn’t mean your home has to be massive. Bigger isn’t always better, and a large house can come with a lot of extra costs that you may not expect.

It’s important to stay alert to signs that you may be in over your head when it comes to your house. The ideal situation is to find a balance between your lifestyle, budget, and your home. When you go to bed at night, your home should feel like a blessing, not a burden.

Related Guides:

Stacy Randall is a wife, mother, and freelance writer from NOLA that has always had a love for DIY projects, home organization, and making spaces beautiful. Together with her husband, she has been spending the last several years lovingly renovating her grandparent's former home, making it their own and learning a lot about life along the way.

More by Stacy Randall

![10 Best Electric Lawn Mowers - [2022 Reviews & Top Rated Models]](https://cdn-fastly.upgradedhome.com/media/2023/07/31/9070486/10-best-electric-lawn-mowers-2022-reviews-top-rated-models.jpg?size=350x220)